Is Pre-Settlement Funding Right for You? Here’s What You Need to Know

If you've heard of pre-settlement funding but aren't sure whether you qualify or how it could help, you're not alone. Many people facing a personal injury lawsuit struggle with mounting bills, lost wages, and uncertainty about their financial future.

At PrimeCare Network, we understand how overwhelming this time can be, and we’re here to help.

What Is Pre-Settlement Funding?

Pre-settlement funding allows plaintiffs in personal injury lawsuits to receive a cash advance on a portion of their expected settlement. Unlike traditional loans, there are no monthly payments, no upfront costs, and no repayment if your case doesn’t result in a win. It’s a non-recourse form of funding, meaning the financial risk stays with the funding company—not you.

Who Needs Pre-Settlement Funding?

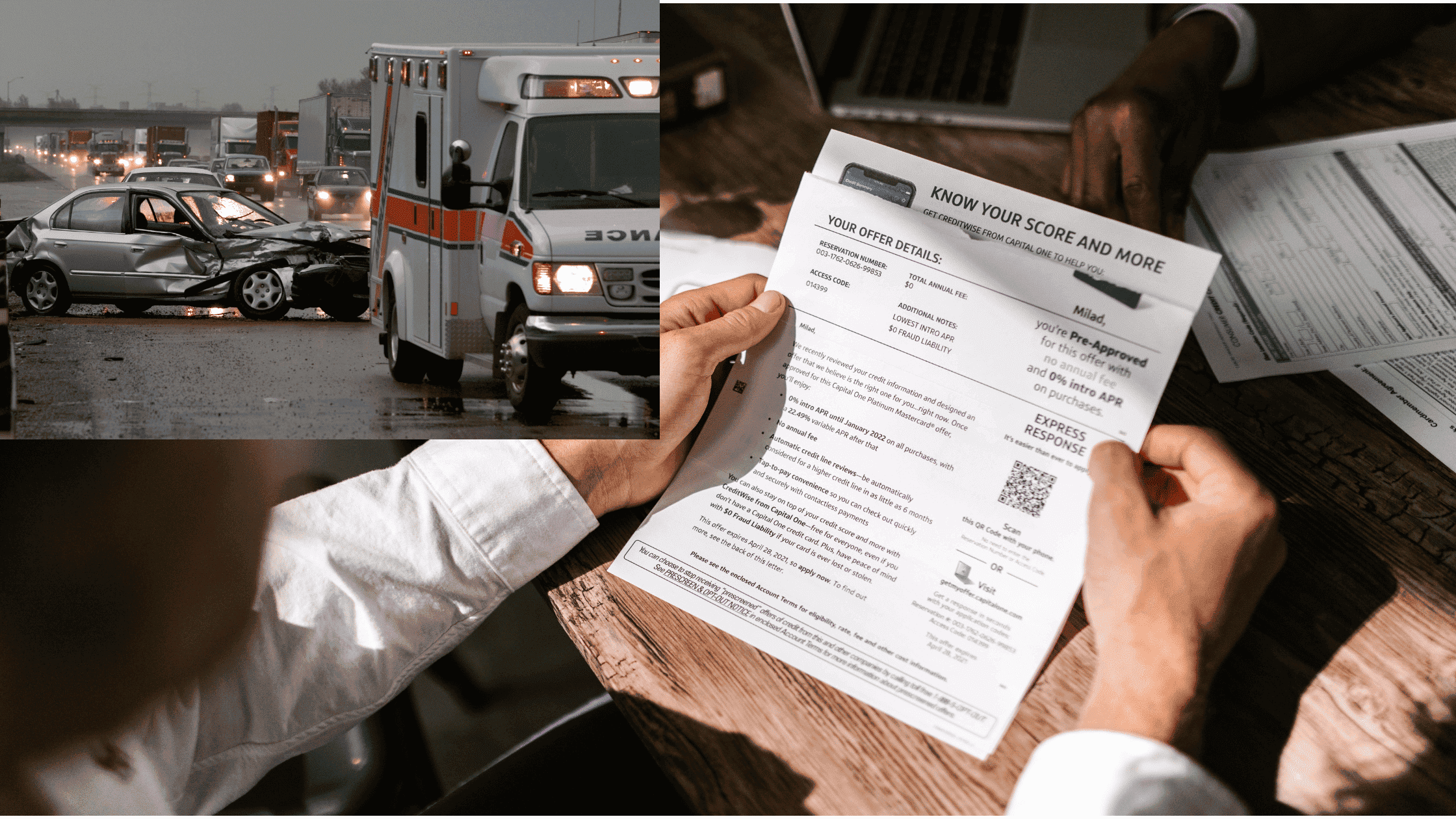

If you’ve been injured in an accident, are unable to work, and are waiting for your case to settle, pre-settlement funding can help. Imagine a single mother injured in a car crash caused by a distracted driver. She can’t work, has mounting medical bills, and needs to care for her children. PrimeCare Network can provide the financial assistance she needs until her case is resolved.

Types of Pre-Settlement Funding

Pre-settlement funding is available for various types of cases, including:

-

Car/Auto Accidents

-

Slip & Fall / Premises Negligence

-

Construction Negligence

-

FELA (Railroad Injuries)

-

General Negligence

-

Pedestrian Accidents

-

Workplace Negligence

-

Wrongful Death Claims

7 Reasons to Consider Pre-Settlement Funding

-

Cover Daily Expenses Rent, groceries, utility bills, and childcare don’t wait for a legal settlement. Pre-settlement funding helps ease that burden.

-

Avoid Rushed Settlements Access to funds allows your attorney the time needed to negotiate a fair settlement—not a quick one.

-

Pay Medical Bills Now Don’t delay crucial treatments. Use your advance to pay for surgeries, rehab, or medication.

-

Support for Your Family Funding can help keep your household stable during your legal proceedings.

-

No-Risk Financial Solution If you don’t win or settle your case, you owe nothing. That’s the non-recourse benefit.

-

Fast Approval Once you apply and your attorney confirms case details, approval can happen within 24-48 hours.

-

Trusted Partner in PrimeCare Network We offer a quick, simple process, transparent terms, and personal attention throughout the process.

How the Pre-Settlement Funding Process Works:

-

Apply Online: Start at primecarentwk.com/apply-now

-

Case Review: We work with your attorney to evaluate your claim.

-

Approval: If eligible, you can get approval quickly.

-

Funding: Receive your funds fast via direct deposit, check, or Western Union.

Get the Relief You Deserve

Waiting for a legal settlement shouldn't mean living under financial stress. Pre-settlement funding from PrimeCare Network can give you the breathing room to focus on healing and justice.

Call 888-474-8473 or Apply Now at https://www.primecarentwk.com/apply-now to learn more.

Disclaimer: PrimeCare Network works with Oasis to provide pre-settlement funding, also known as consumer litigation funding, through different products based on state regulations and the nature of your legal case. Depending on your location or case type, funding may be offered through a purchase agreement assigning part of your settlement proceeds or as a pre-settlement loan (e.g., in SC and CO). These forms of funding differ significantly. We urge you to carefully review the details of any offer with your attorney before proceeding.